18 May 3 Things That Could Help Get You Back on Course

Most investors’ accounts have taken a hit lately and the markets are still volatile. The good news is that you don’t have to wait to take action. Hoping and waiting are not strategies. Here are three proactive steps that could help get you back on course.

Professional tax analysis

There could be opportunities to save money waiting to be found in your tax returns. There may be ways to lower the taxes on both your income and capital gains. You could potentially take those savings to improve your cash flow or investment accounts or both.

Many investors are sitting on unrealized capital gains (stock options, appreciated income property, etc.) because they don’t want to pay taxes on the gains. Understandable, but they are strategies to reduce, defer, and eliminate cap gains taxes while putting the principle back to work for you.

There are also strategies to lower an investor’s taxable income. Not every strategy is right for everyone of course, but they may be worth evaluating in your situation. You won’t know until you talk to a knowledgeable, experienced professional. But time is a factor. You may only have as little as 45 days in some cases to take advantage of a particular strategy.

Because of the tax deadline extension, your tax professional may have time to help you plan a strategy to legally lower your taxes. You just have to talk to someone who knows how and is willing to advise you. Strategies like tax-loss harvesting and Roth conversions may be worth considering this year. Also see the article, “Why You’re Not Getting Tax Advice From Your Tax Professional.” If you’re not getting the help you want for your current tax pro, let’s talk.

Consider using a self-directed brokerage account in your 401(k)

If you’re not happy with the choices in your employer’s retirement plan, there is something that you can do about it.

You probably have a brokerage window in your plan that will allow additional investment options. This applies to 401(k)s, 403(b)s, and 457 plans. This isn’t a rollover or an in-service distribution. Your account stays where it is. You will just have more choices available in your current plan. Ask your advisor about a brokerage window or a self-directed brokerage account. If you get a blank stare, ask us.

Consider Alternative Investments

Investors are not only looking for ways to get back to even but to avoid another volatility gut-punch in the future. Years ago, investors and advisors would use bonds to provide consistent income without market volatility. Bonds were the steady (and even boring) part of a portfolio, which was appealing. But in this current interest rate environment, bonds have become less attractive because of their low returns. Coupled with recent market volatility, more investors are considering “alts” as a bond substitute.

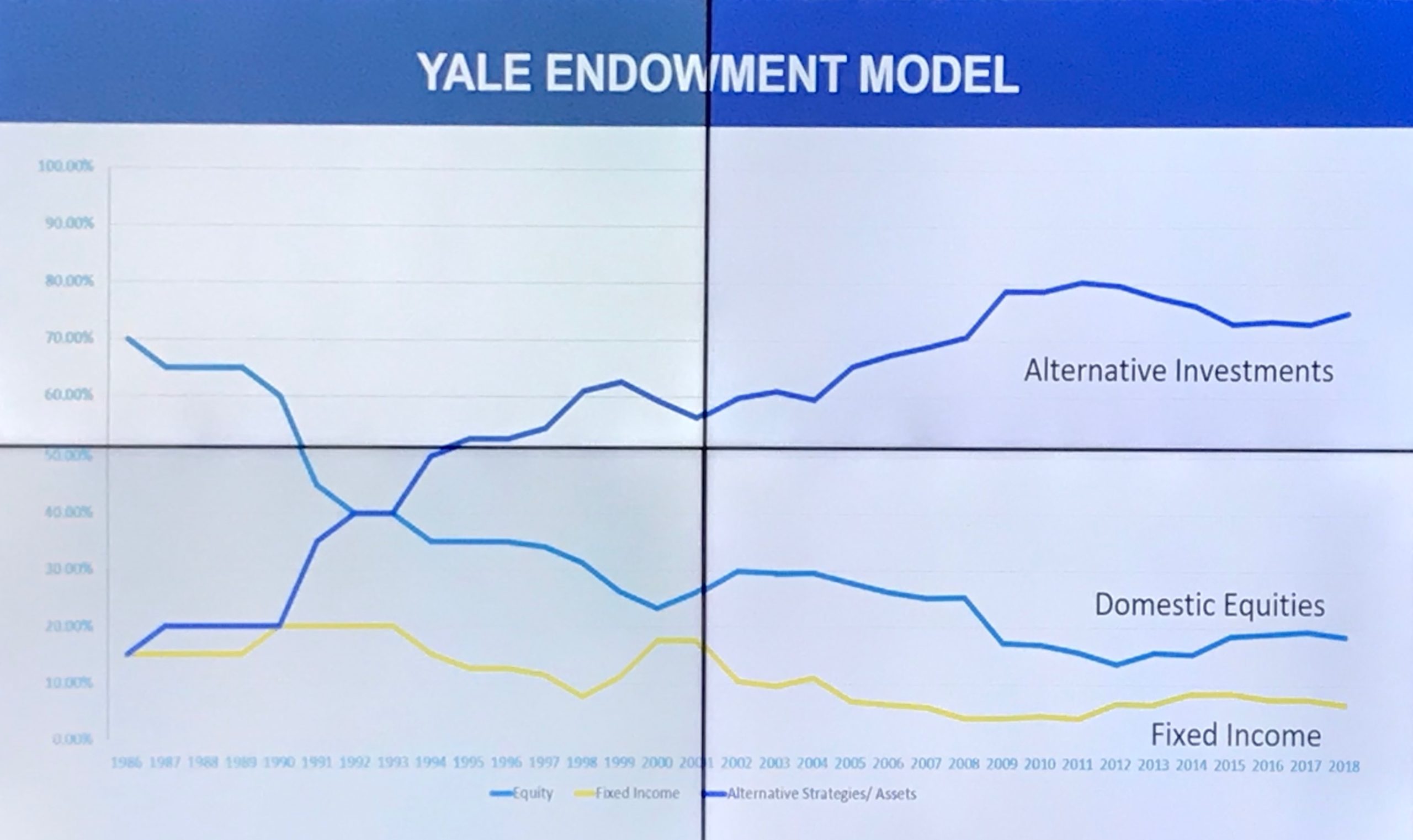

Although “alternative investments” might sound exotic, they’ve been used for years by large endowments and institutions to de-risk portfolios. The key feature of alternative investments is that they generally have a lower (or zero) correlation to the overall markets and therefore can smooth out overall volatility.

Who uses alts? The Yale Endowment for one. It manages over $30 billion and has been using alts for decades. “Over the past 30 years, Yale dramatically reduced [it’s] Endowment’s dependence on domestic marketable securities by reallocating assets to nontraditional asset classes. The heavy allocation to non-traditional asset classes stems from their return potential and diversifying power.”[1]

Alts can take many forms including real estate, private debt, commodities, energy, and so on. Their liquidity can range from months to years.

Previously, alternative investments weren’t generally available to individual investors. That has changed. In fact, alts are so plentiful now that it can be difficult to know which ones to pick for your portfolio. Like any investment, the alt and the sponsor should be thoroughly vetted. Some alts are only available through a financial advisor who can help you evaluate the investment and decide on proper allocation.

The Bottom Line

There are actions that you can consider now that could help you get back on course. Waiting and hoping aren’t strategies and these are not DIY projects. Using an experienced professional with the right tools and who is acting in a fiduciary capacity could help you discover opportunities and take action.

As always, we are here to help. Let’s set up a call.