What is Tax Planning?

Tax planning is the use of proactive, forward-looking strategies to reduce future taxes.

Taxes are intertwined with all other aspects of financial planning.

Decisions about when to sell investments, how to take distributions from retirement accounts, when to claim Social Security, and which investments are best in which types of accounts all involve both income tax and investment expertise.

I meet tax preparers every week who are essentially just historians, recording tax events from the previous year, and then telling you how much you owe. It’s hard if not impossible to find a tax preparer who proactively advises their clients on how to reduce future taxes in a meaningful way. Think about it, when was the last time you got advanced tax reduction advice from your tax preparer?

Strategies for reducing taxes can include income shifting, expense shifting, business entity selection, finding and using all legal deductions. Actual tactics to reduce capital gains taxes can include tax loss harvesting, Qualified Opportunity Zone Funds and Section 1031 DSTs. For reducing income taxes, strategies might include a employer retirement plan, energy investments, or charitable donations. Many tax preparers have never used these strategies.

I work with my clients’ tax professionals when I can to construct strategies to reduce their overall tax burden. Our firm has access to over 70 tax strategies.

Having my focus on reducing taxes and having the right tools in my toolbox truly sets our firm apart from others.

Most financial advisors are competing based on performance: a rate of return better than the other firm. I want to earn your business by demonstrating my value in reducing your taxes and providing tax alpha.

I know the power of genuine tax planning and the harsh impact of no planning.

Click here and let me do a tax analysis for you.

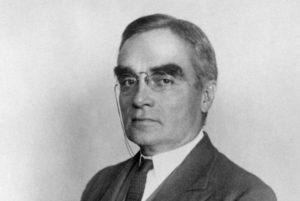

Anyone may arrange his affairs so that his taxes shall be as low as possible; he is not bound to choose that pattern which best pays the treasury. There is not even a patriotic duty to increase one's taxes.

Over and over again the Courts have said that there is nothing sinister in so arranging affairs as to keep taxes as low as possible. Everyone does it, rich and poor alike and all do right, for nobody owes any public duty to pay more than the law demands.``

-Judge Learned Hand, Helvering v. Gregory, 69 F.2d 809, 810 (2d Cir. 1934), aff'd, 293 U.S. 465 (1935)