31 Jul SEP IRA vs. Solo 401(k): Which Should You Choose?

Last week I wrote about how a Solo 401(k) Could Be Your Best Retirement Plan Option.

When it comes to picking a retirement plan, you have many choices. If you have no employees in your business, none of the choices are bad. Let’s start there and assume that you have no employees.

Which is retirement plan is better for a solopreneur, a solo 401(k) or a SEP IRA?

Planning point. As a one-person business, you can operate as a C or S corporation, single member-LLC, or proprietorship and have either the SEP IRA or the solo 401(k).

Ease of Setup

The SEP IRA option is easier to set up—but there’s no rocket science required to establish a 401(k) plan. All the major institutions like Schwab, Fidelity, etc. have both SEP IRAs and Solo 401(k)s that are no or low cost and they will act as trustee.

You do have to pay attention to the solo 401(k) requirements, as they can change, but in general, your trustee is going to help you stay in compliance.

Form 5500

One filing requirement that you need to pay attention to is that once your 401(k) account reaches $250,000 in assets, you must file Form 5500 with the IRS each year.1 And your trustee likely does not do this for you for a solo 401(k). You’ll probably have engage your tax preparer to help with this. In any case, Form 5500 EZ is, well, easy. It’s a two-pager. Don’t let it scare you off.

The SEP rules do not require you to file Form 5500.

Why consider a Solo 401(k)?

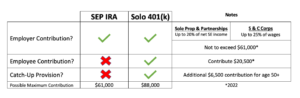

There are two reasons to consider a solo 401(k): higher contribution limits and a catch-up provision.

With a solo 401(k), annual deductible contributions to the business owner’s account can come from two sources:

Source 1 (You): Elective Deferral Contributions

For 2022, you can contribute to your solo 401(k) account up to $20,500 ($27,000 if age 50 or older) of 3

- your W-2 income if you are employed by your own C or S corporation, or

- your net self-employment income if you operate as a sole proprietor or as a single-member LLC that’s treated as a sole proprietorship for tax purposes.

Source 2 (Your Business): Employer Contributions

On top of your elective deferral contribution, the solo 401(k) arrangement permits an additional employer contribution of up to 25 percent of your corporate salary (S & C Corps) or 20 percent of your net self-employment income (Sole Proprietors and Partnerships).

For purposes of calculating the employer contribution, your compensation or net self-employment income is not reduced by your elective deferral contribution.4

- With a corporate plan, your corporation makes the employer contribution on your behalf.

- With a plan set up for a sole proprietorship or a single-member LLC, you are effectively treated as your own employer. Therefore, you make the employer contribution on your own behalf.5

Strange, But True

Note that the one-person business is both an employee and an employer for the solo 401(k). It’s this ability to contribute twice to a solo 401(k) that really sets it apart from a SEP IRA.

SEP IRA Has One Leg

With the SEP, you look at the employer contribution only—which is up to 25 percent of your W-2 wages if you operate as a corporation or 20 percent of your self-employment income, as adjusted.6

Comparison Example

Brayden Stout earns $19,000 from freelance work performed as an independent contractor.

- Under the solo 401(k) rules, Brayden could contribute almost all of the $19,000 in net earnings to a solo 401(k). ($17,658 to be exact.)

- Under the SEP IRA rules, he could contribute only about $3,800 ($19,000 x 20%).

Let’s look at the the “Catch-Up Provision”

If you are under age 50 and your income is on the higher side, the 2022 ceiling on contributions is $61,000.

But if you are age 50 or older, the solo 401(k) has a catch-up provision that allows you to contribute another $6,500, creating a maximum 2022 potential of $67,500.7

The SEP IRA does not allow a catch-up contribution.

Planning point. The 401(k) catch-up contribution must come from an employee deferral.

Example. Sam Jones, age 53, operates a very profitable C corporation that pays him a big W-2 wage. The C corporation contributes $58,000 to Sam’s 401(k). That’s the employer’s maximum—the lesser of $58,000 or 25 percent of Sam’s W-2 wages. Sam may make an employee elective deferral of $6,500 that reduces his taxable income for the year and adds to his retirement fund, making $64,500 ($58,000 + $6,500) the total contributions to his solo 401(k) for the year.

Key Comparison

The SEP IRA contribution can be made only by the employer—employee contributions are not allowed!

The solo 401(k) plan allows both employer and employee contributions.

Example. Rose Rice, a self-employed engineer under the age of 50 has an annual profit of $120,000.

- With the SEP IRA, Rose can contribute a maximum of $22,304. 8

- With the solo 401(k), Rose can contribute a maximum of $42,804 ($20,500 as an employee and $22,304 as the employer).

Takeaways

The key to big retirement plan savings is to start early, make it automatic and invest well.

And of course, the more money you can invest well, the more your retirement nest egg grows.

You have several retirement plan options. In this article, we made a comparison for the business owner with no employees other than him or herself (if incorporated) and the SEP IRA with the solo 401(k) and offered the following insights:

- A SEP IRA is typically easier and cheaper to set up than a solo 401(k).

- With the solo 401(k), you must file Form 5500 EZ once your plan assets exceed $250,000.

- In most cases, the owner of a one-person business can sock away more money for retirement with the solo 401(k) than with the SEP IRA because the solo 401(k) allows both the employee elective deferral and the employer contribution.

If your like to discuss your option with retirement plans, set up a time to chat.

To Your Continued Success,

Footnotes:

1 IRS Publication 560, Qualified Plans (2020), Dated Mar. 9, 2020, p. 21.

2 Instructions for Form 5500-EZ (2020), p. 2.

3 IR 2020-244.

4 IRC Section 404(n).

5 IRC Section 402(i).

6 IRS Publication 560, Simplified Employee Pensions (SEPS) (2020), Dated Mar. 9, 2020, ps. 6, 14, 23, and 24.

7 IRC Section 414(v); Notice 2020-79.

8 https://www.solo401k.com/calculator/ Calculated as net business income of $120,000 – deduction for Self-Employment Tax of $8,478 multiplied by 20% (annual contribution percentage of the employer). This results in the total business profit after self employment taxes and employer contributions to the retirement plan. And who said tax stuff isn’t fun?